Michael Joseph: Outgoing Safaricom CEO Michael Joseph will have an informal fireside chat session at the Nairobi iHub this month ( details here on how to attend). It will be staged like one of the Warren Buffet town hall meetings, and he will take questions from the audience and talks about his legacy at Safaricom.

Serena: last Monday had the bell ringing ceremony to launch newly issued shares of TPSEA (Serena Hotels Group) at the Nairobi Stock Exchange (NSE) after the company raised 1.1 billion shillings ($14.5 million) from shareholders. The funds will be used for: development of 3 hotel properties in Nanyuki, Nakuru and Elementaita (through Jaja Limited), buy 51% of Upekee Lodges who own two properties in South Tanzania, acquire Mbuzi Mawe Tented Camp and Mountain Village (Arusha) and increase the group's investment in TPS Rwanda from 8% to 17% (through refurbishments of Kigali Serena)

Also at the launch:

- Amish Gupta of standard investment bank called for day trading at the exchange (with settlement at the close of business), which he said, would raise turnover by 150% at the NSE

- Eddy Njoroge, chair of the stock exchange called for more companies to consider using the Nairobi stock exchange for capital raising, noting that Serena were able to raise Kshs 1.1 billion in two months - faster than any bank loan of that magnitude. F. Okello, the Serena Chairman - who’s also a Barclays Bank director, diplomatically did not challenge that point.

Centum Diversifies: Results and resolutions passed at the 2010 Centum (formerly ICDCI) AGM were published in the newspaper on Monday. The extra-ordinary business approved by shareholders at the meeting included:

- Business of Reli holdings (a 100% subsidiary now called centum investments) which sold its shares in Rift Valley Railways for Kshs 265 million and paid dividend to centum shareholders

- Uhuru heights limited (a 100% subsidiary), which is developing a plot on Uhuru highway worth 35.9 million

- Runda Closeburn (a subsidiary) which is in the process of buying 100 acres of land adjacent to Runda for 1.16 billion

--> Used to be a shareholder of Centum, but lost interest when they became too vested in other listed companies that all investors had access to. Yes it is healthy for an investment company to have a liquid portion of the portfolio, but Centum, Olympia and other investment companies should invest in unlisted companies (railways, real estate, coca cola bottling plants) that not available to the public - that is their attraction.

Lotteries Galore Zain and Safaricom both have lottery claim to give away a million shillings each week. Zane actually had a press launch the day before Safaricom launched theirs, but did not go public till over a week after Safaricom Masonko 150 did. So did Safaricom pre-empt Zain? Or did Zain pre-empt Safaricom without getting all the necessary approvals or having all the operations in place? Anyway, Zain’s promo is to enhance their subscriber loyalty program, while Safaricom is to mark tenth anniversary of the company.

This week urban IT consulting launched Supapesa which promises Kshs 50 million of prizes’ and last month saw the conclusion of massive 90 million in 90 days. Mbugua Njihia wrote about the lottery, also known as Shinda Smart and which a Nairumor has it grossed Kshs 1.2 billion from over 20 million SMS messages received.

But the winners are genuine of the lotteries and appear in the newspaper clutching bundles of cash or weeping as they receive new car keys - I don't know any of them personally, but I know many faithful participants who remit spend a few shillings each day, sending in the daily lottery SMS and all hoping (& praying) they will be the next winner.

But from what I know about gambling & lotteries is the house (organizer) is always the real winner, so it seems companies have landed on a new money making scheme based on unrealistic public expectations and naivety about the odds of winning prizes.

Showing posts with label Pyramid schemes. Show all posts

Showing posts with label Pyramid schemes. Show all posts

Thursday, October 07, 2010

Idea Exchange: Michael Joseph, Serena, Lotteries

Friday, June 05, 2009

Pyramid Schemes in East Africa

Back in October 2006, I wrote two posts about pyramid schemes that had mushroomed and would eventually ‘burn’ thousands of investors in Kenya.

And the last year has revealed bigger pyramid scams in the form of Bernie Madoff and Alan Stanford, and just yesterday in the Kenya Parliament, some political leaders were un-masked as some of the master minds behind some of the collapsed Kenyan schemes.

Image of pyramid investors from another business daily newspaper article on pyramids

So what was the genesis of the schemes and how they ended? And more important, can they happen again?

Pyramids Rise

- Early investors reaped, and told others about their success - i.e. doubling, tripling or even greater returns in a few months span

- Some schemes were promoted by churches (who received tithes in return)

- Pyramids opened new offices and hired new staff all around the country

- New pyramids opened up cloning existing ones, but promoting a slightly different product/concept

- People took loans to invest in pyramids

- Peoples sold land/ shares / other assets to invest in pyramids

- Pyramid investors cut across all sectors from rural farmers to bank managers

Pyramids Peak

- Early investors reaped, but were greedy and ploughed back as much as they won

- Pyramids grew so big they overwhelmed their managers – some stopped accepting new depositors (but not new deposits which were essential to the chain)

- Banks complained they were losing deposits at a time when interest rates were very low

- With IPO's few and far between, stockbrokers complained they were losing investors during a bull market period

Pyramids Fall

- Banks put the squeeze on pyramid schemes, by freezing these recipient accounts with the funds in them

- Pyramids without cash, tried to switch to different banks and accounts to process their funds

- Banks warned other banks and the Central Bank issued some cautionary notices on schemes

- Some pyramids tried to convert into cooperative societies

- Some schemes bad-mouthed other pyramid schemes as unstable

- When locked out of banks, pyramids moved to safe houses in residential areas where they continued to receive/pay cash

- media coverage kicked in; some angry investors complained on TV about lost money and brought media crews to the safe houses showing other angry investors

- Deposits dried up, and investors demanded their cash.

- Pyramid schemes all collapsed largely at the same time in 2007

Sifting the rubble

Could they have been prevented?

- They were unregulated: Neither the central bank, capital markets or co-operative sector regulator had over-sight over the schemes. Parliament was focused on micro-finance and anti money-laundering regulation bills.

- KYC: Schemes relied on the banking system to move around the money; and if banks applied true know your customer (KYC) principles, they’d have smelled a rat - with hundreds of people queuing in their halls to deposit funds into a single customers account

Unanswered questions

- What happens to the millions of shillings frozen in bank accounts?

- What happened to employees of these schemes? And if rogue stockbrokers were partly brought crash down by thefts from within (internal fraud /‘robbers robbing robbers’) could this also have happened at some schemes?

- Legal grey area still exists. Have any promoters being charged in court? Can any investors sue promoters for losses? The Cooperatives Ministry Task Force is looking at how to compensate investors - but is this justifiable?

- Can schemes rise again? History teaches us that pyramid/ponzi schemes will happen again and again. Maybe using the mobile money transfers, or next time there’s an election. The Business Daily mentions they may have spread to neighbouring countries

And the last year has revealed bigger pyramid scams in the form of Bernie Madoff and Alan Stanford, and just yesterday in the Kenya Parliament, some political leaders were un-masked as some of the master minds behind some of the collapsed Kenyan schemes.

So what was the genesis of the schemes and how they ended? And more important, can they happen again?

Pyramids Rise

- Early investors reaped, and told others about their success - i.e. doubling, tripling or even greater returns in a few months span

- Some schemes were promoted by churches (who received tithes in return)

- Pyramids opened new offices and hired new staff all around the country

- New pyramids opened up cloning existing ones, but promoting a slightly different product/concept

- People took loans to invest in pyramids

- Peoples sold land/ shares / other assets to invest in pyramids

- Pyramid investors cut across all sectors from rural farmers to bank managers

Pyramids Peak

- Early investors reaped, but were greedy and ploughed back as much as they won

- Pyramids grew so big they overwhelmed their managers – some stopped accepting new depositors (but not new deposits which were essential to the chain)

- Banks complained they were losing deposits at a time when interest rates were very low

- With IPO's few and far between, stockbrokers complained they were losing investors during a bull market period

Pyramids Fall

- Banks put the squeeze on pyramid schemes, by freezing these recipient accounts with the funds in them

- Pyramids without cash, tried to switch to different banks and accounts to process their funds

- Banks warned other banks and the Central Bank issued some cautionary notices on schemes

- Some pyramids tried to convert into cooperative societies

- Some schemes bad-mouthed other pyramid schemes as unstable

- When locked out of banks, pyramids moved to safe houses in residential areas where they continued to receive/pay cash

- media coverage kicked in; some angry investors complained on TV about lost money and brought media crews to the safe houses showing other angry investors

- Deposits dried up, and investors demanded their cash.

- Pyramid schemes all collapsed largely at the same time in 2007

Sifting the rubble

Could they have been prevented?

- They were unregulated: Neither the central bank, capital markets or co-operative sector regulator had over-sight over the schemes. Parliament was focused on micro-finance and anti money-laundering regulation bills.

- KYC: Schemes relied on the banking system to move around the money; and if banks applied true know your customer (KYC) principles, they’d have smelled a rat - with hundreds of people queuing in their halls to deposit funds into a single customers account

Unanswered questions

- What happens to the millions of shillings frozen in bank accounts?

- What happened to employees of these schemes? And if rogue stockbrokers were partly brought crash down by thefts from within (internal fraud /‘robbers robbing robbers’) could this also have happened at some schemes?

- Legal grey area still exists. Have any promoters being charged in court? Can any investors sue promoters for losses? The Cooperatives Ministry Task Force is looking at how to compensate investors - but is this justifiable?

- Can schemes rise again? History teaches us that pyramid/ponzi schemes will happen again and again. Maybe using the mobile money transfers, or next time there’s an election. The Business Daily mentions they may have spread to neighbouring countries

Wednesday, September 17, 2008

Anatomy of Local Collapse

With Lehman, AIG, Bear Stearns, Merrill Lynch and other banks in the news, or in need of a rescue, it’s time to look how does this play out locally?

Kenya has experienced several collapses over the last few years – from listed companies (Uchumi supermarket), stockbrokers (Nyaga, Francis Thuo), insurance companies (Invesco), medical plans (mediplus), Banks (Euro, Daima, Charterhouse), and numerous pyramid schemes. What are the stages?

Before: First come the rumors, which can be whispers from clients facing frustrations, or sometimes well meaning staff leak to their trusted clients that something is amiss. At any given time, a company could face this and currently there are murmurs about a stockbroker, a transport company, and an insurance company - but none about banks.

During: Next the rumors gather steam and reach serious partners who deny the company access to cash that it needs to survive. The struggling company will by this time have stopped paying on time and will be known for inventing excuses for delays in payment. So suppliers will stop deliveries (bare shelves), customers withdraw cash and banks will refuse to lend to ailing to the company/bank.

An aside - in the current issue of the Financial Post, entrepreneur Dr. Manu Chandaria talks about the secrets of Asian company success including using supplier credit as the expansion capital - and he emphasizes that a growing company to have a perfect reputation with creditors to get the supplier financing to grow

But eventually word leaks out and depositors try and withdraw their cash from the bank or pyramid, a major creditor moves to seize assets, any of which may hasten the collapse of the company; Eventually the government or a bank may try and appoint a receiver, but often its too late.

After: If there is enough hue and cry or a serious precedent likely to have far reaching effects, the government may step in and try and revive the company – the government has capitulated to the cries of shareholders, suppliers, farmers (sugar/coffee etc.) and politicians several times over the years and tried to revive numerous companies that have collapsed.

If it’s a bank, its depositors get paid up to 100,000 shillings ($1,400) from the deposit protection fund, if its an insurance or medical company it’s a total loss for subscribers who will have to source for new cover packages even if the company had enough assets left. The fate of shareholders is still been sorted out at Nyaga and Francis Thuo, while its a total loss for the thousands who ‘invested’ in unregistered pyramid schemes even though millions of shillings of their ‘profits’ remain unclaimed in bank accounts that have been frozen.

Employees of the companies quietly get new jobs and airbrush the unfortunate period from their CV’s

Lehman employees

Owners/Principals rarely face prosecutions, and having amassed enough to survive a few years of legal battles, may retire quietly or sometimes end up in parliament

Locally: So far it appears that the succesful AIG Kenya [worth ~$35 million] will be insulated from its parent problems. It will probably be absorbed by another local insurance company or CBA bank who are a major shareholder.

Kenya has experienced several collapses over the last few years – from listed companies (Uchumi supermarket), stockbrokers (Nyaga, Francis Thuo), insurance companies (Invesco), medical plans (mediplus), Banks (Euro, Daima, Charterhouse), and numerous pyramid schemes. What are the stages?

Before: First come the rumors, which can be whispers from clients facing frustrations, or sometimes well meaning staff leak to their trusted clients that something is amiss. At any given time, a company could face this and currently there are murmurs about a stockbroker, a transport company, and an insurance company - but none about banks.

During: Next the rumors gather steam and reach serious partners who deny the company access to cash that it needs to survive. The struggling company will by this time have stopped paying on time and will be known for inventing excuses for delays in payment. So suppliers will stop deliveries (bare shelves), customers withdraw cash and banks will refuse to lend to ailing to the company/bank.

An aside - in the current issue of the Financial Post, entrepreneur Dr. Manu Chandaria talks about the secrets of Asian company success including using supplier credit as the expansion capital - and he emphasizes that a growing company to have a perfect reputation with creditors to get the supplier financing to grow

But eventually word leaks out and depositors try and withdraw their cash from the bank or pyramid, a major creditor moves to seize assets, any of which may hasten the collapse of the company; Eventually the government or a bank may try and appoint a receiver, but often its too late.

After: If there is enough hue and cry or a serious precedent likely to have far reaching effects, the government may step in and try and revive the company – the government has capitulated to the cries of shareholders, suppliers, farmers (sugar/coffee etc.) and politicians several times over the years and tried to revive numerous companies that have collapsed.

If it’s a bank, its depositors get paid up to 100,000 shillings ($1,400) from the deposit protection fund, if its an insurance or medical company it’s a total loss for subscribers who will have to source for new cover packages even if the company had enough assets left. The fate of shareholders is still been sorted out at Nyaga and Francis Thuo, while its a total loss for the thousands who ‘invested’ in unregistered pyramid schemes even though millions of shillings of their ‘profits’ remain unclaimed in bank accounts that have been frozen.

Employees of the companies quietly get new jobs and airbrush the unfortunate period from their CV’s

Lehman employees

Owners/Principals rarely face prosecutions, and having amassed enough to survive a few years of legal battles, may retire quietly or sometimes end up in parliament

Locally: So far it appears that the succesful AIG Kenya [worth ~$35 million] will be insulated from its parent problems. It will probably be absorbed by another local insurance company or CBA bank who are a major shareholder.

Tuesday, October 02, 2007

Kutwa Tuesday: death of the cyber café

Once, long ago, I wrote a paper about a business case to put up a cyber café in an airport terminal – for transit passengers to browse there as they waited for the flight to connect. That model is in place today in airports all over the world (not my doing) but its’ time may already have passed with wi-fi zones and wireless laptops whose users don’t need to use cyber cafe facilities anymore.

But even cyber cafes’ that are in town may be under threat.

Until three months ago I’d spend about an hour in a cyber cafe each Saturday and Sunday. I’d go there to my check my-email and then browse quite a bit when I was done.

But all that has stopped as I now check my email and browse for information I need to know instantly – from hotmail, gmail, sports scores, stock prices - using a plain old phone (not bambanet, or blackberry) as the Safaricom EDGE service is available on most of their phones even some of the cheaper ones. I get the information wherever I am and don't have to visit a cyber cafe unless it's to print a document or download a PDF report.

Oil slick

The sale of Somken petrol stations to the National Oil Corporation of Kenya (NOCK) has been put on hold ever since the previous NOCK MD resigned from the company. Haggles remain over the high price bid for the stations.

BAT smoke-out

BAT Ghana has voluntarily de-listed from the Ghana Stock Exchange.

Does that portend anything for BAT Kenya one of the blue chip stocks on the Nairobi stock exchange and one of the highest paying dividend stocks? Cigarette smokers have had their smoking freedom curtailed in Nairobi and other urban areas (Nairobi city has less than a half dozen outdoor smoking points) making them clandestine smokers who hide on staircases and bathrooms (but at least most bars retain a smoking section). What impact will that have on sales?

BAT Kenya manufactures cigarettes here and exports a significant amount to other regional countries (who have not curtailed smoking) which should cushion it slightly from the new laws.

Stockbroker still frozen

The statutory management of Francis Thuo stockbrokers (by the Nairobi Stock Exchange) has been extended for another six months.

the pyramids that collapsed

Much has changed in the one year since nyramid schemes were highlighted here. Since then they have come under increasing pressure from the government, SACCO’s and most important the banks who frozen account necessary for their operations (and who probably still hold the schemes ‘missing billions’ that investors are crying for).

The latest collapse was Amity and it was preceded by Sasanet investment co-op (suspended operations), Spell investments (suspended operations), Circuit investments (suspended operations), CLIP (suspended operations), DECI (suspended operations), and the Kenya business community savings & credit society (Kenya akiba) (suspended operations)

Kenya news on Youtube

Some people say they are tired of political news, while others can’t get enough of it. But the Nation Media Group has gone ahead and made their new clips available on Youtube

Pesa point wins

Two yard ago Pesapoint was launched and it began a battle with Kenswitch - another network of banks sharing ATM facilities. But today Pesa Point has signed up most mid-size banks and have a network of almost 200 ATM machines – and last month added corporate banking giant Standard Chartered to their network.

But even cyber cafes’ that are in town may be under threat.

Until three months ago I’d spend about an hour in a cyber cafe each Saturday and Sunday. I’d go there to my check my-email and then browse quite a bit when I was done.

But all that has stopped as I now check my email and browse for information I need to know instantly – from hotmail, gmail, sports scores, stock prices - using a plain old phone (not bambanet, or blackberry) as the Safaricom EDGE service is available on most of their phones even some of the cheaper ones. I get the information wherever I am and don't have to visit a cyber cafe unless it's to print a document or download a PDF report.

Oil slick

The sale of Somken petrol stations to the National Oil Corporation of Kenya (NOCK) has been put on hold ever since the previous NOCK MD resigned from the company. Haggles remain over the high price bid for the stations.

BAT smoke-out

BAT Ghana has voluntarily de-listed from the Ghana Stock Exchange.

Does that portend anything for BAT Kenya one of the blue chip stocks on the Nairobi stock exchange and one of the highest paying dividend stocks? Cigarette smokers have had their smoking freedom curtailed in Nairobi and other urban areas (Nairobi city has less than a half dozen outdoor smoking points) making them clandestine smokers who hide on staircases and bathrooms (but at least most bars retain a smoking section). What impact will that have on sales?

BAT Kenya manufactures cigarettes here and exports a significant amount to other regional countries (who have not curtailed smoking) which should cushion it slightly from the new laws.

Stockbroker still frozen

The statutory management of Francis Thuo stockbrokers (by the Nairobi Stock Exchange) has been extended for another six months.

the pyramids that collapsed

Much has changed in the one year since nyramid schemes were highlighted here. Since then they have come under increasing pressure from the government, SACCO’s and most important the banks who frozen account necessary for their operations (and who probably still hold the schemes ‘missing billions’ that investors are crying for).

The latest collapse was Amity and it was preceded by Sasanet investment co-op (suspended operations), Spell investments (suspended operations), Circuit investments (suspended operations), CLIP (suspended operations), DECI (suspended operations), and the Kenya business community savings & credit society (Kenya akiba) (suspended operations)

Kenya news on Youtube

Some people say they are tired of political news, while others can’t get enough of it. But the Nation Media Group has gone ahead and made their new clips available on Youtube

Pesa point wins

Two yard ago Pesapoint was launched and it began a battle with Kenswitch - another network of banks sharing ATM facilities. But today Pesa Point has signed up most mid-size banks and have a network of almost 200 ATM machines – and last month added corporate banking giant Standard Chartered to their network.

Tuesday, June 26, 2007

Convenient banking

making trades offs as convenient banking is not the same thing as cheap banking

Equity has been the fastest growing bank in the country over the last few years. It has won customers, now 1+ million, and has sent bigger banks banks back to the drawing board to woo & retain their customers.

However, while banking with them may not be cheap for a business, it is convenient, and offers finance and flexibility to an upcoming business. People coming from abroad complain about the cost of making mobile calls here – saying they are expensive. But compared to what? A taxi driver will make a 30 shilling mobile phone call to secure a 2,000 shilling job as his phone is his office.

Same with Equity their low entry minimums suit individuals and start ups. And while some of their charges are rather hefty (3% for ENC and 10% of amount for a temporary overdrafts), as a businesswoman told me today, their quick decision making and the fact that they are the only bank that can offer these facilities to her make them the optimal bank for now. Getting cheques cleared, guarantees, and payments to suppliers matter more to her now, than the cost of these services, and help her build a credit record for the future. Once she is more established,. she will look question the transaction costs and have other banks now wooing her business.

Other banking briefs

According to Africa confidential, Kenya is favored to be the new host country for the African development bank, with Botswana second in the ranking. However Ivory Coast is back in the running following the signing of a peace accord. More on homeless banks.

The CBR Bank rate was lowered from 10 to 8.5%

The Government has commissioned a study to look into the low uptake of youth enterprise fund and agriculture development funds. They are blaming banks for asking borrowers for collateral and 3 month bank statements – terms which were not spelt out in the funds. from an offline story from the East Africa:

CFC Stanbic bank pre –merger comparisons

Diamond Trust acquired a majority shareholding in Diamond Trust in the just concluded rights issue.

Equity Bank

- Looking to enter the money transfer business

- To buy Housing Finance bank - what do the bloggers say?

Family bank got admitted to the CBK bank clearing house earlier in June, just a few weeks after being licensed. Family took advantage and pressed for an exemption (on a two year waiting period), similar to that granted to Equity Bank when it also became a bank. from an offline story from the standard

National Bank is seeking to commit Ketan Somaia to civil jail over a 17 million debt

Pyramids schemes continue to

thrive despite numerous warnings. However, some schemes feeling a cash pinch are passing the blame to the central bank who are limiting the interest they can pay depositors to 10% p.a. - before they were paying over 10% per month.

Equity has been the fastest growing bank in the country over the last few years. It has won customers, now 1+ million, and has sent bigger banks banks back to the drawing board to woo & retain their customers.

However, while banking with them may not be cheap for a business, it is convenient, and offers finance and flexibility to an upcoming business. People coming from abroad complain about the cost of making mobile calls here – saying they are expensive. But compared to what? A taxi driver will make a 30 shilling mobile phone call to secure a 2,000 shilling job as his phone is his office.

Same with Equity their low entry minimums suit individuals and start ups. And while some of their charges are rather hefty (3% for ENC and 10% of amount for a temporary overdrafts), as a businesswoman told me today, their quick decision making and the fact that they are the only bank that can offer these facilities to her make them the optimal bank for now. Getting cheques cleared, guarantees, and payments to suppliers matter more to her now, than the cost of these services, and help her build a credit record for the future. Once she is more established,. she will look question the transaction costs and have other banks now wooing her business.

Other banking briefs

According to Africa confidential, Kenya is favored to be the new host country for the African development bank, with Botswana second in the ranking. However Ivory Coast is back in the running following the signing of a peace accord. More on homeless banks.

The CBR Bank rate was lowered from 10 to 8.5%

The Government has commissioned a study to look into the low uptake of youth enterprise fund and agriculture development funds. They are blaming banks for asking borrowers for collateral and 3 month bank statements – terms which were not spelt out in the funds. from an offline story from the East Africa:

CFC Stanbic bank pre –merger comparisons

Diamond Trust acquired a majority shareholding in Diamond Trust in the just concluded rights issue.

Equity Bank

- Looking to enter the money transfer business

- To buy Housing Finance bank - what do the bloggers say?

Family bank got admitted to the CBK bank clearing house earlier in June, just a few weeks after being licensed. Family took advantage and pressed for an exemption (on a two year waiting period), similar to that granted to Equity Bank when it also became a bank. from an offline story from the standard

National Bank is seeking to commit Ketan Somaia to civil jail over a 17 million debt

Pyramids schemes continue to

thrive despite numerous warnings. However, some schemes feeling a cash pinch are passing the blame to the central bank who are limiting the interest they can pay depositors to 10% p.a. - before they were paying over 10% per month.

Tuesday, May 22, 2007

Kutwa Tuesday

These are stories I have found (kutwad) and want to share this Tuesday

Getting a story straight: One way of getting your story out through the media is to buy space and have your statement run exactly as you mean it and straight to the public - and there are two recent instances of that.

Street Lights: First is by the CEO of Adopt-A-Light Esther Passaris who launched her transformed street lighting crusade into an anti-poverty and anti-corruption vehicle that may lead her to being the next mayor of Nairobi.

This comes after the City council of Nairobi disowned the contract they had with her company and advertised for other companies to fulfill outdoor lighting & advertising functions which were had been exclusively done by Adopt a light.

What’s in your water bottle?: The second statement is a concerned water expert who is worried that Kenyans may not understand the different types of bottled water being sold - drinking water, natural mineral water, mineral water, carbonated water etc. - and that water bottling companies are being liberal with the advertising truth. He writes that natural mineral water is bottled at source, and with no chemical treatment, which is an expensive process - and he doubts that it is possible for a company actually producing such water, can sell it at the same price as drinking water. I.e. some of the companies are making false claims on their water bottles. He also cautions users to check the amount of fluorine in bottled water as it can lead to bad teeth and bone disease (Should not be more than 1.5mg per litre)

Do they work?: Of course the media love a story waged on their papers and companies such as Kakuzi, Portland cement, Kenya pipeline, Nzoia Sugar and other companies have all bought space (in more than one newspaper) to run statements, usually denying allegations of financial impropriety. There was even an infamous statement defending Anglo Leasing a few years ago.

Esther Passaris took out 2 page advertisements in both the Sunday Nation and Sunday Standard – probably at a total cost of Kshs 1.5 million (840,000 for the Nation, and over 600,000 for the standard)

The media is happy because these statements add to advertising revenue and often lead to other statements and form a base for them to tackle stories that they may have been hesitant to delve into. IMHO, it is unwise for corporations to place such self-serving advertisements especially to deny allegations – the better thing is to lie low and let the bad press (negative stories) pass, plant a few trees & build schools (CSR is good first aid for a scandal wound), answer questions from regulators or authorities – but don’t splash your story in the media!

(See past PR statements by De La Rue and Italians in Malindi.

Communications Wananchi has applied for a data carrier network operator - DCNO license - joining other firms such as KDN, Simbanet, Telkom, UUNET and Access Kenya.

Bounty Hunter: In a Ugandan newspaper, I came across an article (copy here) about the search for Felicien Kabuga who is wanted for his role in the 1994 Rwanda genocide. The article had more depth than any story I have read in any Kenyan paper (fear of libel laws perhaps), but what continues to amaze me is that despite almost every literate urban Kenyan knowing about the search, a reward on offer of $5m (down to Kshs 335 million at current exchange rate), recent photos of Kabuga that the Nation published a few months ago, and significant evidence that he spends a great deal of time in Kenya – no one (his friends & associates) cares enough, for posterity, or for the reward, to turn this guy in. And now there’s a deadline - as the mandate for the International Criminal Tribunal for Rwanda (ICTR) and presumably the reward will expire at the end of 2008.

Brother please! Just came across this story - which at first I thought was from the the Onion or some satire website. But it appears to be a true story – that the wreckage of a six-seater aircraft has been found in Cameroon three months after it crashed. So should we be greatful that the KQ crash site was found within 48 hours?

Money go round: Even as some of the larger pyramid schemes are experiencing cash flow problems, smaller ones are still attracting new investors. In the newspapers every day there are more schemes in the works listed in the classified sections under business opportunity – all offering 16 – 20% returns per month, just for investing a small amount for a weeks.

Real estate The Kenya anti corruption authority (KACA) is seeking land in milimani, upper hill, kilimani or wastelands, presumably to set up a new office building. Lots sought should be 2 to 5 acres in size, close to major road and details should be sent to the Director by June 14.

Mining

- On J7 July at the Msambweni divisional office, a case will be heard between Simon Ndungu Karanja vs. Tiomin over his 1.9 ha piece of land

- Gippsland offshore petroleum of Australia is doing an geophysical survey of the Kenya coast (kipini area, ungama bay)

- Tile & carpet center are prospecting for carbon dioxide in (Kereita forest) of Kiambu district

- Oil giant Halliburton is moving is headquarters from Houston to Dubai!

Getting a story straight: One way of getting your story out through the media is to buy space and have your statement run exactly as you mean it and straight to the public - and there are two recent instances of that.

Street Lights: First is by the CEO of Adopt-A-Light Esther Passaris who launched her transformed street lighting crusade into an anti-poverty and anti-corruption vehicle that may lead her to being the next mayor of Nairobi.

This comes after the City council of Nairobi disowned the contract they had with her company and advertised for other companies to fulfill outdoor lighting & advertising functions which were had been exclusively done by Adopt a light.

What’s in your water bottle?: The second statement is a concerned water expert who is worried that Kenyans may not understand the different types of bottled water being sold - drinking water, natural mineral water, mineral water, carbonated water etc. - and that water bottling companies are being liberal with the advertising truth. He writes that natural mineral water is bottled at source, and with no chemical treatment, which is an expensive process - and he doubts that it is possible for a company actually producing such water, can sell it at the same price as drinking water. I.e. some of the companies are making false claims on their water bottles. He also cautions users to check the amount of fluorine in bottled water as it can lead to bad teeth and bone disease (Should not be more than 1.5mg per litre)

Do they work?: Of course the media love a story waged on their papers and companies such as Kakuzi, Portland cement, Kenya pipeline, Nzoia Sugar and other companies have all bought space (in more than one newspaper) to run statements, usually denying allegations of financial impropriety. There was even an infamous statement defending Anglo Leasing a few years ago.

Esther Passaris took out 2 page advertisements in both the Sunday Nation and Sunday Standard – probably at a total cost of Kshs 1.5 million (840,000 for the Nation, and over 600,000 for the standard)

The media is happy because these statements add to advertising revenue and often lead to other statements and form a base for them to tackle stories that they may have been hesitant to delve into. IMHO, it is unwise for corporations to place such self-serving advertisements especially to deny allegations – the better thing is to lie low and let the bad press (negative stories) pass, plant a few trees & build schools (CSR is good first aid for a scandal wound), answer questions from regulators or authorities – but don’t splash your story in the media!

(See past PR statements by De La Rue and Italians in Malindi.

Communications Wananchi has applied for a data carrier network operator - DCNO license - joining other firms such as KDN, Simbanet, Telkom, UUNET and Access Kenya.

Bounty Hunter: In a Ugandan newspaper, I came across an article (copy here) about the search for Felicien Kabuga who is wanted for his role in the 1994 Rwanda genocide. The article had more depth than any story I have read in any Kenyan paper (fear of libel laws perhaps), but what continues to amaze me is that despite almost every literate urban Kenyan knowing about the search, a reward on offer of $5m (down to Kshs 335 million at current exchange rate), recent photos of Kabuga that the Nation published a few months ago, and significant evidence that he spends a great deal of time in Kenya – no one (his friends & associates) cares enough, for posterity, or for the reward, to turn this guy in. And now there’s a deadline - as the mandate for the International Criminal Tribunal for Rwanda (ICTR) and presumably the reward will expire at the end of 2008.

Brother please! Just came across this story - which at first I thought was from the the Onion or some satire website. But it appears to be a true story – that the wreckage of a six-seater aircraft has been found in Cameroon three months after it crashed. So should we be greatful that the KQ crash site was found within 48 hours?

Money go round: Even as some of the larger pyramid schemes are experiencing cash flow problems, smaller ones are still attracting new investors. In the newspapers every day there are more schemes in the works listed in the classified sections under business opportunity – all offering 16 – 20% returns per month, just for investing a small amount for a weeks.

Real estate The Kenya anti corruption authority (KACA) is seeking land in milimani, upper hill, kilimani or wastelands, presumably to set up a new office building. Lots sought should be 2 to 5 acres in size, close to major road and details should be sent to the Director by June 14.

Mining

- On J7 July at the Msambweni divisional office, a case will be heard between Simon Ndungu Karanja vs. Tiomin over his 1.9 ha piece of land

- Gippsland offshore petroleum of Australia is doing an geophysical survey of the Kenya coast (kipini area, ungama bay)

- Tile & carpet center are prospecting for carbon dioxide in (Kereita forest) of Kiambu district

- Oil giant Halliburton is moving is headquarters from Houston to Dubai!

Sunday, March 04, 2007

10 shilling shares

The recent surge of share splits was unjustified based on the overall trading history of the companies. So it’s only a matter of time before some of these shares dip to their pre-split / hype prices. Any share that was trading for less than 100 shillings in the last 18 months is a candidate for correction – to the below 10 shillings mark and that includes CMC, ICDCI, and Sasini.

IPO’s

Now that a few IPO’s have passed, but not their euphoria, it is apparent that investment advisors of future IPO's will have to rework their calculations to satisfy institutional and seasoned retail investors. While government divestment offers will be geared to the mwananchi, smaller private companies will have to ask themselves if by offering IPO shares at about 10/= each, they want to be like Eveready or Scangroup and end up with up with 100,000 shareholders who own 100 – 200 shares each.

Rising shareholder costs

- Kengen told us their 2006 annaul general meeting (AGM) - after the IPO would 80 million shillings and another post IPO company Firestone will have their AGM in Nakuru on March 22 (where fewer shareholders can attend).

- With over 175,000 new shareholders, the cost to Eveready of even inviting all their new owners to the AGM is quite prohibitive - mailing out accounts & AGM notices would cost about 4 million shillings ($63,500) [i.e. 175,000 letters X 25 shillings postage per letter]. So Firestone shareholders will also be asked to approve a change in company articles to allow such notices to be sent by e-mail or fax.

- The same postage costs will apply when Eveready mail out their dividend cheques. Since most shareholders have the minimum 100 shares, they will receive payment cheques of Kshs 60. which is hardly justified when you factor in bank & postage charges

- Also to cut costs, the company has sent out slimmed down accounts that are about the size of the president's speech on Jamhuri day.

- On a positive note, Kengen have made an arrangement with (their bankers) KCB so that shareholders can cash their Kengen dividend cheques at any KCB branch at no cost.

Alternative investments

KTN had a story on Friday about the Central Bank (CBK) crackdown on pyramid schemes - and it was followed by a poll on whether they should be banned. The result was 16% YES, 84% NO (i.e. they should not be banned.) Though unscientific, you sense from the poll that these schemes have become lifelines/shortcuts to riches for a diverse variety of Kenyans.

In fact many of these schemes have been shut down at the urging of commercial banks – who have had to deal with swelling crowds in their banking halls – either depositing or receiving cash in the merry go rounds. Some of these investors blame jealousy from banks (who want to hold their money and give out as loans) and the Nairobi stock exchange for putting pressure on the CBK to act (since they have been selling shares to re-invest in these quick cash back avenues with guaranteed returns.

IPO’s

Now that a few IPO’s have passed, but not their euphoria, it is apparent that investment advisors of future IPO's will have to rework their calculations to satisfy institutional and seasoned retail investors. While government divestment offers will be geared to the mwananchi, smaller private companies will have to ask themselves if by offering IPO shares at about 10/= each, they want to be like Eveready or Scangroup and end up with up with 100,000 shareholders who own 100 – 200 shares each.

Rising shareholder costs

- Kengen told us their 2006 annaul general meeting (AGM) - after the IPO would 80 million shillings and another post IPO company Firestone will have their AGM in Nakuru on March 22 (where fewer shareholders can attend).

- With over 175,000 new shareholders, the cost to Eveready of even inviting all their new owners to the AGM is quite prohibitive - mailing out accounts & AGM notices would cost about 4 million shillings ($63,500) [i.e. 175,000 letters X 25 shillings postage per letter]. So Firestone shareholders will also be asked to approve a change in company articles to allow such notices to be sent by e-mail or fax.

- The same postage costs will apply when Eveready mail out their dividend cheques. Since most shareholders have the minimum 100 shares, they will receive payment cheques of Kshs 60. which is hardly justified when you factor in bank & postage charges

- Also to cut costs, the company has sent out slimmed down accounts that are about the size of the president's speech on Jamhuri day.

- On a positive note, Kengen have made an arrangement with (their bankers) KCB so that shareholders can cash their Kengen dividend cheques at any KCB branch at no cost.

Alternative investments

KTN had a story on Friday about the Central Bank (CBK) crackdown on pyramid schemes - and it was followed by a poll on whether they should be banned. The result was 16% YES, 84% NO (i.e. they should not be banned.) Though unscientific, you sense from the poll that these schemes have become lifelines/shortcuts to riches for a diverse variety of Kenyans.

In fact many of these schemes have been shut down at the urging of commercial banks – who have had to deal with swelling crowds in their banking halls – either depositing or receiving cash in the merry go rounds. Some of these investors blame jealousy from banks (who want to hold their money and give out as loans) and the Nairobi stock exchange for putting pressure on the CBK to act (since they have been selling shares to re-invest in these quick cash back avenues with guaranteed returns.

Monday, November 13, 2006

IPO fizzle

No disrespect to the Eveready IPO which opens today, but there appears to be less enthusiasm for what it now the 3rd IPO this year after Kengen and Scangroup. There are lines outside stockbrokers today, and will be around for the next two weeks but nowhere near Kengen size.

Most of the fatigue comes from the over-subscription and resultant fractional allocations of shares to investors – each requiring several trips, phone calls and hours spent pursuing IPO shares.

Likewise to buy Eveready, I’d have to sell something or if I wrote a cheque i'd have to make several trips to my broker - who's normally super efficient. But at IPO time, things get hectic with the long queues and harried staff - payments/orders get misplaced or have to be corrected, and a second trip would likely be in order, followed by a third in a month's time, after the IPO results are known (11/12), to collect the inevitable refund cheque (after 15/12).

I may be better off just waiting to the shares to list (on 18/12) then simply send my broker an e-mail to buy the shares. Price volatility can be expected on day one, but with Christmas around teh corner, there won’t be much activity on the exchange and the price should hold steady (I hope) till January.

Careful banks: Unlike before when several banks lined up to offer loans to buy Kengen shares, they are still available, but there’s no marketing or fanfare announcing them. Also, while Kengen was sold on almost every street corner, this time KCB is the only commercial bank selling Evereyady shares.

Still I must commend some brokers who have opened satellite offices to process IPO applications, thus easing the crowds at their main offices.

BARS free

Barclays shareholders will endorse the sale of their BARS to CAPSEC of South Africa - in addition to a share capital increase, bonus, and share split at an EGM in Nairobi on December 8. Register closes Nov 29

No parking

The latest ludicrous proposal by city council is to double the daily parking fee from 70 to 140 shillings ($2) in order to finance the construction of parking garages. What the council should do is have a bond or enter an arrangement with a bank that will finance construction of the parking in record time and the council can repay the bank over the long term. The council would be ill-advised to finance construction using daily collections of which it has little control. The proposal also has no end date which means we could be paying double for the next 10 years, long after the project is over, or without any new parking garages ever being built.

Posta booster

There's a story in the East African today about how the Postal corporation will reap over 16 million shillings ($226,000) from Kengen mailing annual accounts and notices for their AGM on November 30. Kengen had to pay for tens of thousands of stamps and has budgted 80 million shillings ($1m) for the day.

Nyramid update

A prominent city Church led by a charismatic preacher is behind one of the newest Nyramids.

Tesco’s here

Tesco, a former partner of Uchumi has opened its own Nairobi supermarket.

Cadillac’s to Kenya?

Cadillac returns to Africa via South Africa with right hand drive cars which will then be sold to other Sub-Saharan African countries -with BLS, SRX and STS models arriving early next year. Geenral Motors has a significant presence in the Nairobi through isuzu truck and minibus sales.

Most of the fatigue comes from the over-subscription and resultant fractional allocations of shares to investors – each requiring several trips, phone calls and hours spent pursuing IPO shares.

Likewise to buy Eveready, I’d have to sell something or if I wrote a cheque i'd have to make several trips to my broker - who's normally super efficient. But at IPO time, things get hectic with the long queues and harried staff - payments/orders get misplaced or have to be corrected, and a second trip would likely be in order, followed by a third in a month's time, after the IPO results are known (11/12), to collect the inevitable refund cheque (after 15/12).

I may be better off just waiting to the shares to list (on 18/12) then simply send my broker an e-mail to buy the shares. Price volatility can be expected on day one, but with Christmas around teh corner, there won’t be much activity on the exchange and the price should hold steady (I hope) till January.

Careful banks: Unlike before when several banks lined up to offer loans to buy Kengen shares, they are still available, but there’s no marketing or fanfare announcing them. Also, while Kengen was sold on almost every street corner, this time KCB is the only commercial bank selling Evereyady shares.

Still I must commend some brokers who have opened satellite offices to process IPO applications, thus easing the crowds at their main offices.

BARS free

Barclays shareholders will endorse the sale of their BARS to CAPSEC of South Africa - in addition to a share capital increase, bonus, and share split at an EGM in Nairobi on December 8. Register closes Nov 29

No parking

The latest ludicrous proposal by city council is to double the daily parking fee from 70 to 140 shillings ($2) in order to finance the construction of parking garages. What the council should do is have a bond or enter an arrangement with a bank that will finance construction of the parking in record time and the council can repay the bank over the long term. The council would be ill-advised to finance construction using daily collections of which it has little control. The proposal also has no end date which means we could be paying double for the next 10 years, long after the project is over, or without any new parking garages ever being built.

Posta booster

There's a story in the East African today about how the Postal corporation will reap over 16 million shillings ($226,000) from Kengen mailing annual accounts and notices for their AGM on November 30. Kengen had to pay for tens of thousands of stamps and has budgted 80 million shillings ($1m) for the day.

Nyramid update

A prominent city Church led by a charismatic preacher is behind one of the newest Nyramids.

Tesco’s here

Tesco, a former partner of Uchumi has opened its own Nairobi supermarket.

Cadillac’s to Kenya?

Cadillac returns to Africa via South Africa with right hand drive cars which will then be sold to other Sub-Saharan African countries -with BLS, SRX and STS models arriving early next year. Geenral Motors has a significant presence in the Nairobi through isuzu truck and minibus sales.

Tuesday, October 17, 2006

Nyramid Update

- The communications company identified earlier has stopped accepting new investors or deposits and has told existing investors that their contracts will not be renewed once they expire. (I.e. receive full payment)

- Also, in an e-mail circulating, purpoting to be from Equity Bank, names some of these companies and warns other banks and their customers to be on the look out for these schemes.

To: undisclosed-recipients

Subject: Message from Central Bank

It has come to the knowledge of the Central bank (and other commercial banks) that some fraudsters have opened accounts in the guise of Merry Go Rounds. Be advised that these are in fact pyramid schemes. A pyramid scheme is a fraudulent system of making money which requires an endless stream of recruits for success.

The fraudsters have already mobilized a sizeable number of people who have made colossal sums of deposits. The security machinery has managed to penetrate the cells and is making good progress in this regard. In some incidents, they masquerade as working with the knowledge of the bank.

We make it very clear that the bank is not involved in any way with their operations. This is the more reason why it has been decided that all these accounts cease from receiving any deposits from the public or allow any withdrawal either from the counter or from the ATMs. Any member of the public wishing to deposit or withdrawal should be advised accordingly.

Refer any enquiries to Major Mutua and Security Department in Head Office.

The following accounts have been identified to be receiving suspicious deposits from the public on a daily basis:-

----------------------------------------------------------------------------------

And many others not yet fully identified.

Please circulate this mail to all your friends to avoid more innocent Kenyans getting into the trap.

New NSE listing?

The Daily Nation reports that a new company will soon list on the NSE via a private placement. Midlands Limited will sell 20 million shares to raise 250 million shillings to put up cold storage facility. Suntra has valued the shares of the agro-processing, Nynadarua-based company, which currently has 3,000 shareholders at 28 shillings and they will be listed at at 10.50 each. Related piece.

Sports

- Kenya is bidding to host the 2009 sevens rugby world cup. The organisers, who are up against seven other countries, are deriding the lack of government support. Good luck!

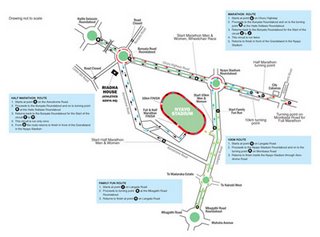

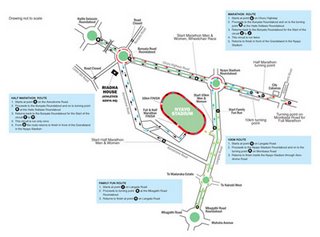

- The 2006 Nairobi Marathon takes place in 12 days. However unlike in previous years where the different races were spread out over different parts of the city from Lenana school, to Nairobi School, to Mombasa Road, this years races will center around the Nyayo Stadium area.

Previous marathons have caused some inconveniend some travellers, church goers, and shoppers, on Sunday morning. However for those interested in watching this prestigious international sporting event will have to go to the race area.

Safaricom security

Safaricom to enhance it's anti-fraud systems.

- Also, in an e-mail circulating, purpoting to be from Equity Bank, names some of these companies and warns other banks and their customers to be on the look out for these schemes.

Subject: Message from Central Bank

It has come to the knowledge of the Central bank (and other commercial banks) that some fraudsters have opened accounts in the guise of Merry Go Rounds. Be advised that these are in fact pyramid schemes. A pyramid scheme is a fraudulent system of making money which requires an endless stream of recruits for success.

The fraudsters have already mobilized a sizeable number of people who have made colossal sums of deposits. The security machinery has managed to penetrate the cells and is making good progress in this regard. In some incidents, they masquerade as working with the knowledge of the bank.

We make it very clear that the bank is not involved in any way with their operations. This is the more reason why it has been decided that all these accounts cease from receiving any deposits from the public or allow any withdrawal either from the counter or from the ATMs. Any member of the public wishing to deposit or withdrawal should be advised accordingly.

Refer any enquiries to Major Mutua and Security Department in Head Office.

The following accounts have been identified to be receiving suspicious deposits from the public on a daily basis:-

----------------------------------------------------------------------------------

And many others not yet fully identified.

Please circulate this mail to all your friends to avoid more innocent Kenyans getting into the trap.

New NSE listing?

The Daily Nation reports that a new company will soon list on the NSE via a private placement. Midlands Limited will sell 20 million shares to raise 250 million shillings to put up cold storage facility. Suntra has valued the shares of the agro-processing, Nynadarua-based company, which currently has 3,000 shareholders at 28 shillings and they will be listed at at 10.50 each. Related piece.

Sports

- Kenya is bidding to host the 2009 sevens rugby world cup. The organisers, who are up against seven other countries, are deriding the lack of government support. Good luck!

- The 2006 Nairobi Marathon takes place in 12 days. However unlike in previous years where the different races were spread out over different parts of the city from Lenana school, to Nairobi School, to Mombasa Road, this years races will center around the Nyayo Stadium area.

Previous marathons have caused some inconveniend some travellers, church goers, and shoppers, on Sunday morning. However for those interested in watching this prestigious international sporting event will have to go to the race area.

Safaricom security

Safaricom to enhance it's anti-fraud systems.

Subscribe to:

Posts (Atom)